Since my wife and I made the commitment to live a debt-free lifestyle, one of the most common objections I have heard is that a credit score is required in order to do certain things, one of which is renting a car. In nearly ten years of having no credit cards, and now over two years of having no debt whatsoever, we have never had an issue - that is - until I tried to rent a car a little while ago. Thankfully not all car rental agencies have such silly requirements.

Renting a Car

A little while ago I had to travel and rent a car. Since moving to Nashville, I've only had to rent a car at an airport a handful of times, and each of those times was while my family still had debt - namely, our mortgage. (We have rented vehicles from a dealership, including a $40,000 12 passenger van, and they never ran a credit check). This time was the first time I had rented at an airport since paying our house off, and was the first time I ever had a problem with a rental agency.

When Summer and I first were married, we traveled quite a bit, and rented from Avis most of the time, as we got a discount with them through our bank. So, going with what I knew, I saw that the discount was still there, so I reserved a car on Avis' website. I booked an economy car, and after the discount the entire rental was about $100 for three nights. Now, I have not had a credit card in almost 10 years, so I did check to see what their debit card policy was. On their site it did say they would run a credit check at the counter, and would want proof of a return flight from the same airport. I was not too worried about this as I keep an eye on my credit report twice a year and had my credit frozen.

Upon arrival at the Avis counter, things went south very quickly. I was asked for my card for the credit check. The lady swiped it, and the computer came back with a rather obscure error - even she did not know what it meant (I am guessing it is not something they encountered frequently). She asked if I had another card - I handed her my "fun money" debit card, which had more than enough to pay for the weekend rental and a deposit if necessary. That too had an issue. She saw the "Visa DEBIT" logo, and asked if I had a credit card, to which I said no. She said there was nothing she could do at that point, and directed me to call their support line.

Just to be sure I did not have an issue at my bank, such as my card getting skimmed, I called them and discovered that my card had not been used at all in 24 hours - not even by Avis' system. I got off the phone with them, and realized I had a credit freeze in place due to a skim happening last year. I asked the counter agent what credit agency they used - Equifax (great....). So, I got my laptop out, found my Unlock PIN, unlocked my credit, and we tried to run my card one more time.

"DO NOT RENT. REFER CUSTOMER TO EQUIFAX"

The counter agent became even less friendly at this point. She was convinced that I did not have the money to rent the car, and said "Why don't you try Thrifty - their standards are ... ahem ... a little lower than ours" (almost verbatim). I started the half mile walk over to Thrifty, and in the mean time called Avis to cancel my "paid up front, no refund" reservation (thankfully they did refund me).

Thrifty's office was dingy compared to Avis, but the counter agents were a lot friendlier. They were more than happy to get me a car on the spot, and though they did not have an economy vehicle, they did get me a nice car in the next tier - a brand new Corolla. They did do a credit check, and checked my return ticket information, but their computer system happily accepted my reservation. The rental ended up being about twice as much, but at least I had a car for the weekend.

It is worth noting that we have enough liquid savings to pay for this car.

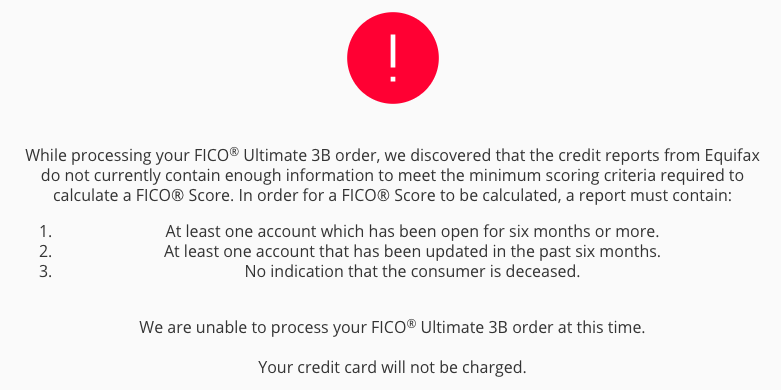

Once I got home, I was still upset about the experience, so I started to look in to the problem. My bank gives me a monthly view into my "score", so I checked there - around 700. Not great, but it had hovered there since we paid the house off two years ago. I then read that sometimes that "score" that a bank provides is not the actual FICO score. I knew Discover card had a free FICO score, so I tried that: big error message. Ok, hmm. I tried ordering a score from Experian. Nope. I ran one of my annual credit reports, nothing strange on there. Finally, I tried myfico.com - I knew I would have to pay to see the scores there, but it would be accurate. After checking out, I was greeted with this error message:

I finally had confirmation of what I had started to suspect. At some point after paying off our home, my credit score dropped to 0, or non existent. I'm not entirely sure when that occurred, but it would have been some time in 2017 or 2018.

I asked around several places, and even e-mailed several rental agencies, and this is what I now know for next time I rent a car.

- Avis - you aren't going to get my business again

- Enterprise - several people with no score told me they have rented from Enterprise. They do a credit check and want to see proof of return flight, but it would appear that they are fine with ZERO score

- Thrifty - also good with ZERO score (at least at this particular airport). They also have a "rent with cash" program, but you have to go through a more thorough check that you need to start 30+ days out

- Cash Deposit Identification Cards - Cash rentals which require an up-front deposit of cash are accepted from customers who have obtained a Cash Deposit Identification (ID) Card. Applications for a Cash Deposit ID Card are available from Thrifty.com. Applicants must be 21 years of age or older (18 in Michigan and New York). The application process can take approximately thirty (30) days except as otherwise required by law. There is a US$15 non-refundable processing fee which offsets the cost to have a modified credit check performed on the applicant

- Hertz - same deal as Thrifty

This was a very frustrating experience, but I do know to rent from better companies in the future. And no, I am not going to run out and get a credit card, so that I can get a score, so that I can rent a car. We have committed to not borrowing money, and not being able to rent from one rental car company is a small price to pay to maintain the freedom that we now enjoy.